Carbon Removal Target Setting Community Discussion: Key Takeaways

In a recent webinar hosted by Milkywire, experts from various organizations came together to discuss carbon dioxide removal (CDR) target setting in a rapidly evolving market landscape. This session, drawing from a comprehensive white paper co-authored by MilkyWire and Klarna, highlighted key insights and strategies for corporations addressing their carbon neutrality commitments. The discussion emphasized and clarified the importance of integrating Carbon Removal in corporate strategies.

Milkywire connects impact-driven companies with validated, high-impact climate projects globally and has partnered with InPlanet since 2023. Their mission is to empower businesses to address their environmental footprint through direct funding. A key initiative, the Climate Transformation Fund, accelerates the deployment of impactful CDR solutions by channeling capital to innovative projects with strong potential for long-term climate benefits. As a crucial intermediary, the fund provides financial backing and connects projects with forward-thinking buyers, de-risking investments and building market confidence.

InPlanet has secured multiple commitments through the Climate Transformation Fund over the past two years. The first included two pre-purchase offtake agreements for deliveries until 2028 to WRLD Foundation and Klarna. Following this, InPlanet secured another purchase via the fund, with an additional commitment from WRLD Foundation.

Klarna has become a significant CDR buyer over the past years, demonstrating a commitment beyond offsetting through its internal carbon tax and strong emphasis on durable removals. Their participation in the Climate Transformation Fund supports pioneering CDR solutions like InPlanet’s ERW projects. Thought leaders like Klarna, engaging in webinars and white papers, are vital for the growth and credibility of the CDR ecosystem.

The discussion featured:

- Robert Höglund, Head of CDR and Climate Strategy at Milkywire

- Alexander Farsan, Head of Climate and Environment at Klarna

- Adina Braha-Honcluc, Carbon Dioxide Removal Lead at Schneider Electric

- Jamila Yamani, Director of Climate and Energy at Salesforce

- Stephen Buskie, Carbon Capture, Storage and Removals, WBCSD

Essential recommendations for companies scaling CDR

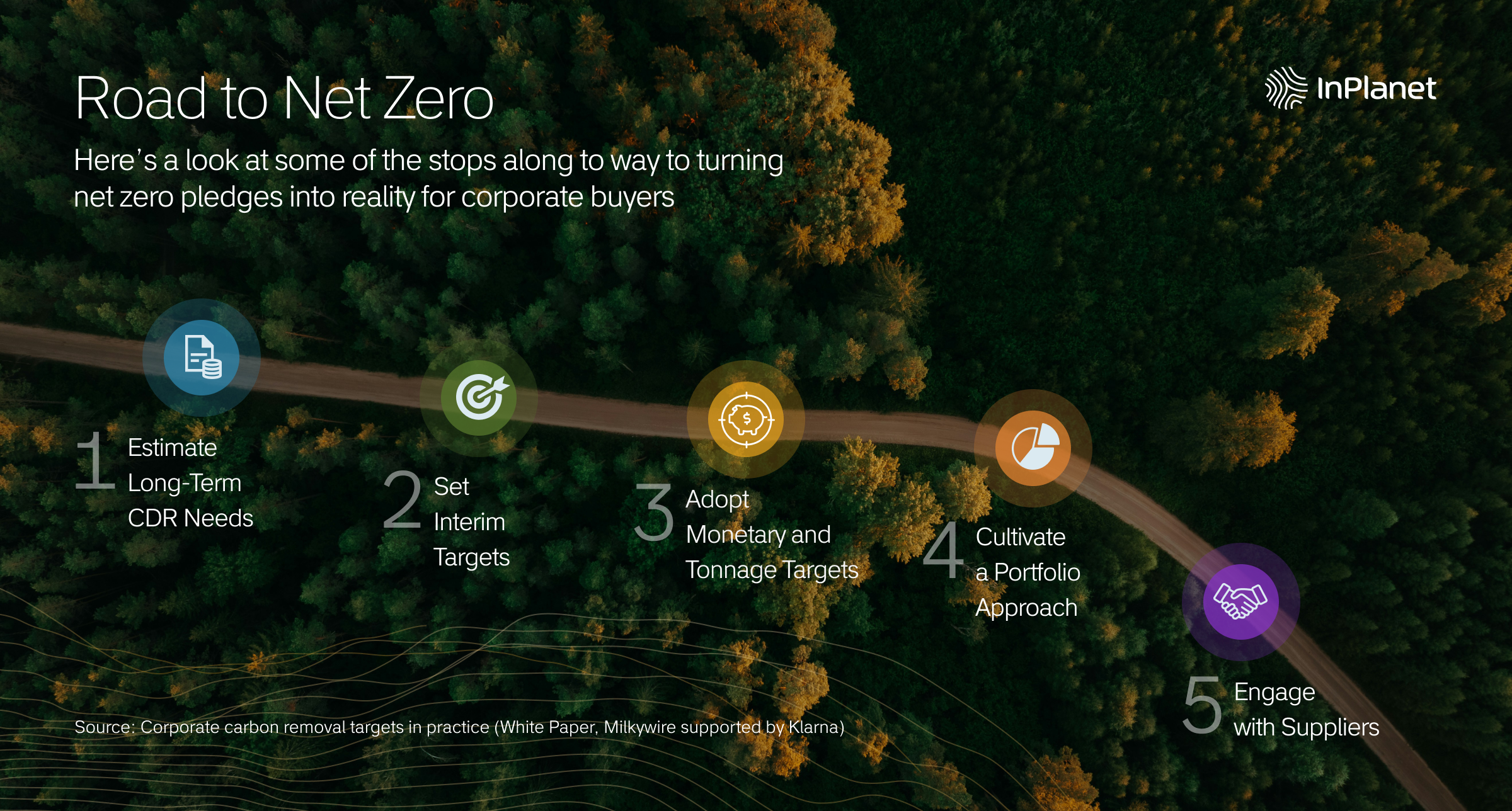

While thousands of companies have pledged to achieve net zero emissions, concrete plans for incorporating CDR into strategies are sparse. “Very few think they’re going to be able to decarbonize all the way to zero without CDR,” noted Robert Höglund, emphasizing the commitment to execution gap. The urgent necessity for scaling CDR technologies was made clear. The webinar presented five essential recommendations for companies to leverage in their target setting: estimating long-term CDR needs, setting interim targets, adopting monetary and tonnage targets, cultivating a portfolio approach, and engaging with suppliers.

Estimate long-term CDR needs

To effectively incorporate CDR into sustainability strategies, companies must start by estimating their future CDR requirements. This involves assessing current emissions and, in parallel, projecting their needs in the years to come. Working with heuristics (experimentation, evaluation, trial and error) can simplify this, as the calculations can become complex. One approach suggests that at least 10% of current scope one, two, and three emissions should be earmarked for CDR. Companies that proactively estimate their long-term carbon removal needs are setting themselves up for success in meeting net zero targets; quantification is key.

Set interim targets

Establishing interim targets is essential for tracking progress toward long-term CDR goals. These benchmarks enable companies to adapt strategies to changing market and technology conditions, ensuring accountability and continuous improvement. They also give leadership clear visibility into how the organization is progressing, helping guide decision-making. Interim targets aren’t just milestones, they’re a dynamic framework that evolves with our understanding of CDR. Companies must be bold and precise in their commitments.

Adopt Monetary and tonnage targets

The two biggest decisions in setting CDR targets are whether to focus on monetary value or tonnage. Monetary targets offer flexibility and can help to drive down prices, while tonnage targets provide clear alignment with emissions reduction goals. Balancing both approaches helps companies stay market-responsive while ensuring meaningful contributions to carbon removal. When operationalizing monetary targets rather than tonnage targets, Jamila Yamani of Salesforce shed light on their commitment of $100M by 2030 in the First Movers Coalition, and why the company buys the equivalent of its residual emissions each year:

“By having a dollar commitment, we’ve been able to remove constraints as far as our commitment to CDR goes. This allows us to think about impact first. In general, some of the existing commitments in the CDR landscape are focused on driving individual companies toward net zero. It’s not often we can leverage these same commitments to accelerate an industry forward; that’s two different things you’re optimizing for. Having a milestone dollar commitment allows us to try to do both, or at least prepare for meeting our net zero target in a way that’s catalytic in the short term.”

Cultivate a portfolio approach

Another key strategy that was discussed for companies managing CDR target setting is to cultivate a portfolio approach. Diversifying CDR strategies is essential, as no single method can address all emission scenarios or meet every company’s climate goals. A portfolio approach, combining both natural and technological solutions, allows companies to hedge against uncertainty, balance cost with permanence, and tap into a broader range of impact. Much like a sophisticated financial portfolio blends short-term and long-term assets to optimize returns and manage risk, a well-structured carbon portfolio mixes nature-based solutions like forestry (with shorter-term carbon storage) alongside engineered removals such as direct air capture (which offer high permanence but at higher cost and lower scalability today). This balance ensures that companies are not overly reliant on one type of removal and can adapt as the market and technologies evolve.

For example, forestry projects may store carbon for decades to a century, but they are vulnerable to reversal due to events like wildfires or deforestation. In contrast, technological solutions like Enhanced Rock Weathering (ERW) offer near-permanent removal, storing carbon for centuries or more, with far less risk of reversal. While these approaches differ in cost, scalability, and maturity, they complement one another in a diversified strategy. By building a carbon removal portfolio that spans various CDR types, companies can spread risk, encourage innovation, and send strong market signals to accelerate the development of emerging solutions. Ultimately, treating carbon credit investments with the same strategic discipline as financial asset management leads to a more credible, resilient path toward net zero.

Engage with suppliers

Relationships matter, and engaging early and continuously with CDR suppliers is essential. Buyers can build strong relationships with suppliers through consistent open communication and documentation. This creates the stability of a more reliable and accessible pipeline of CDR options tailored to a company’s specific needs. Organizations can help stimulate and develop the CDR market by committing to early purchases or long-term contracts. Jamila Amani mentioned that Salesforce’s approach is to consider buying CDR as a de-risking mechanism for the future. Alexander Marsan of Klarna discussed this point and the varied forms that supplier engagement might take:

“It’s not just a commercial transaction, but we’ve been supporting them where we’ve been able to, in giving references, speaking at events with them, or other support. It’s more about demonstrating that their solutions are credible by being outspoken, positive buyers.”

Charting the course for credible climate action

Throughout the webinar, the participants highlighted the challenges of a still-developing CDR market, including uncertainty around standards like the Science Based Targets initiative (SBTi) and the need for clearer guidance on CDR claims and usage. The discussion reinforced the importance of a proactive, credible approach from sustainability leaders to enable meaningful engagement with carbon removal for broader market adoption.

As organizations pursue ambitious net zero goals, it’s clear that CDR will play a central role. Approaches like Enhanced Rock Weathering (ERW) offer promising, scalable solutions, but we at InPlanet believe success depends on thoughtful deployment, robust monitoring, and collaboration across sectors to ensure they deliver lasting climate impact.